Cycling Industries Europe’s 2022 Business Health-Check shows that a majority of CIE member companies are continuing to invest in the sector. The last year saw growth in sales, workforces and marketing, despite concerns about the development of the market and supply chain issues that have shifted from shortages to overstocking. Since 2021 there has been a marked increase in companies that have declining sales and workforces, but it still only touches 17% of respondents, leaving the overall sector trending positively.

CIE health checks began as Business Impact Surveys during the COVID pandemic to inform the industry and governments about the health of the industry due to the pandemic. This resource rapidly became a ”go-to” reference for the sector because it is the only survey of its kind to address business confidence and investments across all cycling sectors, from global giants to services and start-ups. Now CIE repeats the study annually to establish long-term trends.

Presenting the first survey outcomes to CIE members at the trade association’s Members’ Day on 8th March, Marc Anderman, Head of Cycling at Sporting Insights, who have operated the programme for CIE since inception, said “the survey points to continued volatility in the sector as new challenges arose each year, but CIE Members are showing resilience in face of the changes, potentially beating trends in other parts of the industry”.

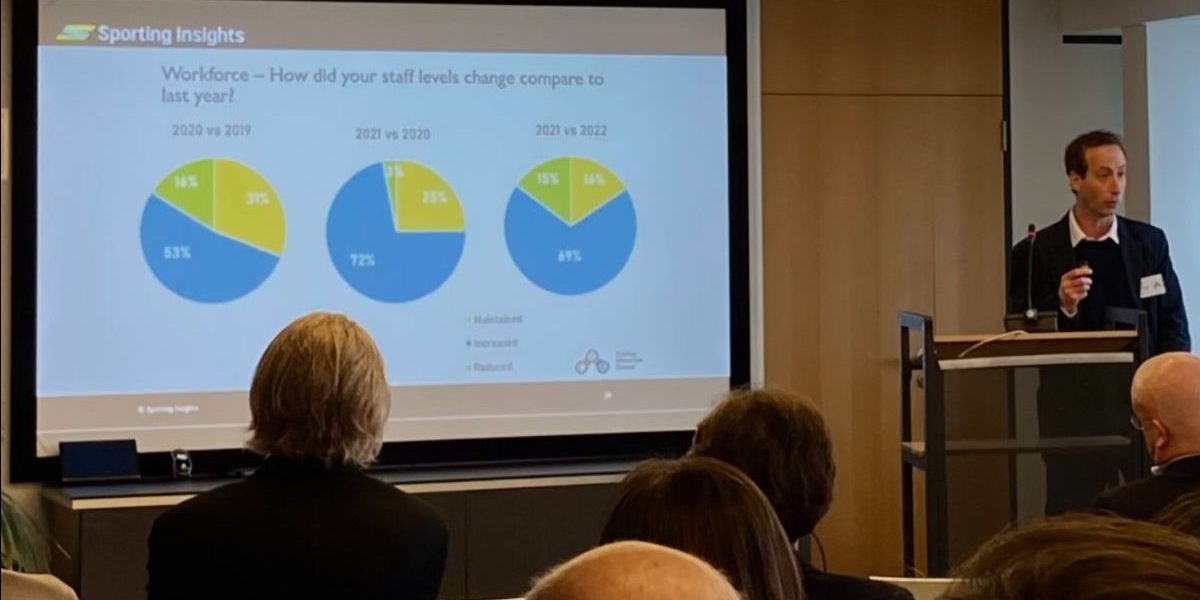

In terms of revenues the number of companies showing growth is still 63%, down on the 78% of 2021, but a remarkable 69% are growing their workforces, looking for appointments in marketing, sales and manufacturing.

The impact of the COVID pandemic is weakening, but it still shows in both positives (demand) and negatives such as supply disruptions. In particular, 69% of companies foresee the end of the supply chain challenges within 18 months; in 2020 this was only 14%. Whole bikes and frames now show significantly lower levels of shortage, while challenges remain in components, electrical components and raw materials.

New questions were asked about the impact of the Russian invasion of Ukraine, with high energy costs and the consequential effect on wage inflation coming through as the major impacts, reflecting the industry’s relatively low exposure to direct sanctions on trade.

Commenting on the results Kevin Mayne, CEO of CIE said “The Health Check confirms what we have heard from other analysis. The fundamentals of our industries are in really good shape, especially when we also see that ridership trends are so strong across Europe. It appears that most CIE members share this confidence, even knowing that 2023 could be a challenging year for some. Our job is to make sure this industry health is supported by the very best analysis and research, helping business leaders develop long-term and economically sustainable business strategies.”

Full reports from the CIE Business Health Check will be available to members of CIE’s Market Impact and Intelligence Expert Group from April 2023. Membership is available from €1000 per year (depending on company size) and open to all companies in the sector. Research copies of the contents will be for sale from April 2023.

Fieldwork for the CIE Business Health Checks was carried out in January 2023.

The survey is an anonymized aggregation of CIE members responses, CIE does not know which companies participated. A list of CIE members can be found here (link CIE Members page)

CIE thanks Sporting Insights for carrying out these surveys and contributing to the success of the cycling business sector in Europe.