Results from the study were first published by Cycling Industries Europe on 25.3.2024 and were presented at the Market Intelligence and Expert Group.

Amidst the gloom surrounding the state of the industry in 2023, Cycling Industries Europe (CIE) was pleasantly surprised to be able to announce more optimism than anticipated among members.

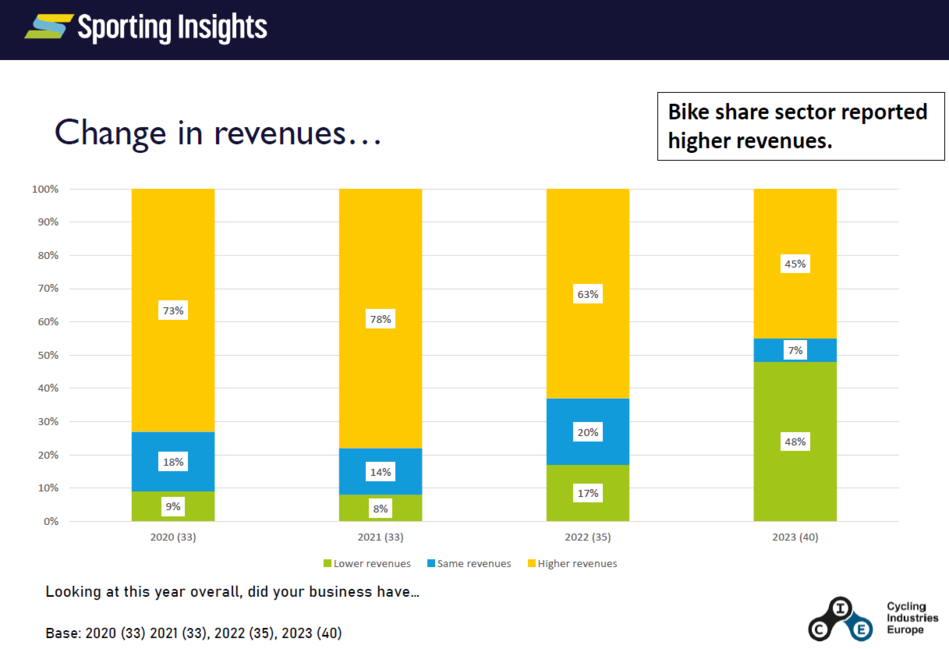

At least half of the respondents reported either an increase or similar revenues in 2024, with the bike share sector leading in revenue growth. Similarly, in terms of employment, at least half of the respondents indicated that they either maintained their workforce size or were actively hiring.

The study, conducted annually by Sporting Insights since 2020 on behalf of CIE, takes a holistic look at the state of the European cycling industry, with respondents representing various segments of the cycling industry, including bikeshare services, bike and parts manufacturers, retailers, and cycling ITS providers.

The number of responses increased compared to 2023.

CIE were also glad to sense optimism among several respondents regarding future investment prospects, tying in with the positive long-term predictions for the growth of the sector. Recent sales figures from key markets like Germany and the Netherlands have also revealed more encouraging outcomes than initially projected.

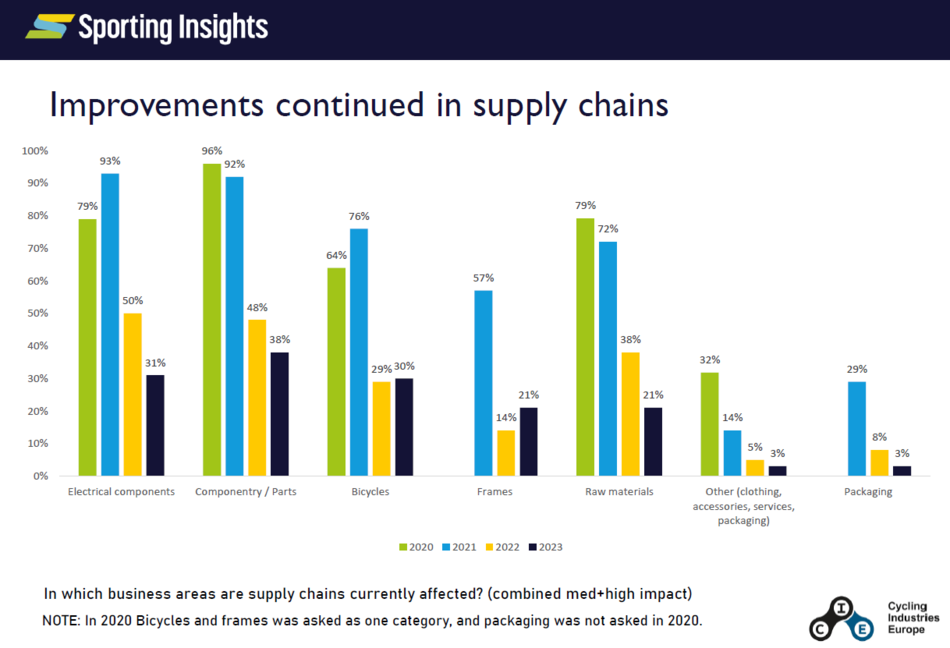

STABILISING SUPPLY CHAINS

Supply chains remain a key concern, with overstock in the bicycle market still prevalent and impacting the price of sales, component orders and the renewal of models. Survey responses nonetheless indicate an expectation that supply chains will stabilise over the course of 2024

Respondents also expect sales will recover in the foreseeable future.

There are further signs of resilience and cause for cautious optimism when reviewing responses on planned expenses and marketing budgets. 65% of companies expect to maintain or increase overall spending, and 62% plan on maintaining or increasing marketing budgets.

One question posed by CIE is whether this relative health and optimism is fully representative of all companies in the cycling ecosystem or, whether it is rather linked the fact that the survey is conducted among CIE members only. The latter benefit from the possibility to collaborate on common industry challenges such as sustainability, learn about growing market segments, turn the networking opportunities our industry platform provides into solid business relationships, and gain extra insights to data and market dynamics, via the activities of the Market Intelligence and Impact Expert Group – to name but a few possible reasons.

ACCESSING THE REPORT

Access to the full CIE Business Impact Survey is one of the many exclusive datasets and benefits CIE Members receive. If you are curious about the extent of data covered in CIE’s expert groups and the industry networking opportunities the platform provides, CIE warmly encourages you to reach out to them at info(at)cyclingindustries.com.

TECHNICAL NOTES

- Fieldwork for the CIE Business Health Checks was carried out in January and February 2024.

- The survey is an anonymised aggregation of CIE members responses, CIE does not know which companies participated. A list of CIE members can be found here.

- CIE thanks Sporting Insights for carrying out these surveys and contributing to the success of the cycling business sector in Europe.