Attendees at the Outdoor Industries Association (OIA) conference received a sneak peak of the first data from the Outdoor Market Intelligence Service (OMIS).

OMIS, delivered by Sporting Insights with the support of the European Outdoor Group (EOG) and OIA, covers an estimated 50% of the market and has historic data going back five years across both mass market and independent channels. Plans are in place to grow the panel further in order to ultimately achieve parity with or exceed the Bicycle Association’s Cycling Market Data Service, powered by Sporting Insights, which tracks an estimated 70% of the market. Already however, OMIS trend data highlights a number of macro factors affecting the UK market, including:

- Average Sale Price (ASP) has gradually increased over the last 5 years across all categories with the combined ASP of all products in 2023 being 11.7% higher than 2022 and over 30% higher than pre-Covid in 2019.

- Though the pandemic resulted in a surge in online sales, which grew significantly in 2020 to represent over 75% of all sales, this has now returned to circa 30% of the market over the past couple of years.

- 2021 witnessed an incredible post-pandemic bounce with the value of sales across the market increasing by over 130%. Apparel and Footwear led this boom.

- 2022 continued on this upward trajectory and even though the market was 11.4% down in 2023 compared to the previous year it was still 9.9% higher than 2021.

- Packs and Luggage is the Department that grew the most between 2023 and 2021, followed by Verticality.

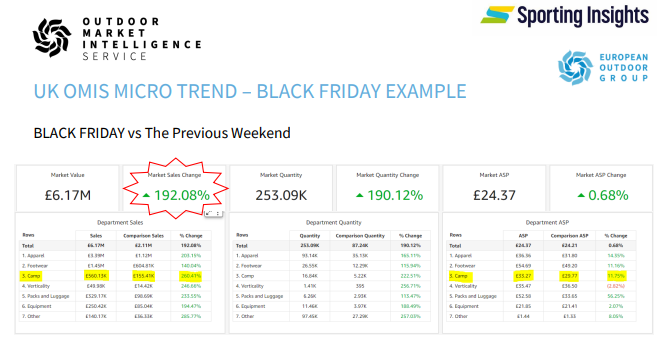

The granularity of the data, which extends to model level, enables retailers to track the impact of individual products and promotions on market dynamics. Richard Payne, Joint Managing Director of Sporting Insights, explained this clearly to the assembled delegates by highlighting the level of uptick in the market delivered by Black Friday 2023. While one concern held by some retailers is that Black Friday delivers footfall and order volume but compromises value and margins, OMIS data indicates a slight increase in average sale price vs the previous weekend, implying that 2023’s discounts encouraged customers not to purchase their usual intended products at reduced prices but pushed them to shop at a higher tier of quality while staying around their usual budget.

Subscriptions to OMIS are now open, with the panel continuing to grow and international expansion underway.

“We all really enjoyed Sporting Insights showing and sharing the power of market intelligence to our conference last week,” said Andrew Denton, CEO of OIA. “This has the potential to completely change how the industry takes decisions and tracks progress, and we encourage as many of our members and partners as possible to take advantage of a demo and explore how this can help their business. Given the amount of data available and how it can be cut, the use for the information is huge. The OIA would strongly recommend at least taking the free demo, talking to Sporting Insights about the OMIS project – it could change the way you run your business forever

Matt Gower, Executive Chair of Equip Outdoor, owners of Rab and Lowe Alpine, added “we were very happy to be the first subscriber. The industry has been needing this essential tool for years, OMIS is setting out to be the first pan-European market data resource. We see this as an essential tool to grow our business.”

“Launching a major market intelligence service like this is a labour of love,” explained Richard, who presented the data, and along with head of Market Intelligence, Robert Cobain, attended both days of the event. “Our team have worked unbelievably hard to reach the point of delivering the first data to the market, and a huge thank you also to the EOG and OIA for their support and to the many retailers who have put their faith in us. It’s great to hear people being blown away by the depth and breadth of data we’ve been able to deliver already, and we now welcome conversations with anyone open to learning how OMIS can enhance their decision making.”

For more information, or to arrange a demo, please contact Robert Cobain.

Sporting Insights delivers analytics to inspire a more active world. With a reputation for robustness and integrity and experience running successful market intelligence services across multiple sports and leisure industries, including the best-in-class Cycling Market Data service on behalf of the Bicycle Association, our insights and data have a proven track record of delivering commercial success.