How We Play Now – Part 2 – The Lockdown

In part one of our series of Coronavirus insights, we examined how sports participation in the UK has reacted to the Coronavirus lockdown. The results suggested that participation had dipped not only in sports that were no longer permitted, like golf or tennis, but also that this decline extended to sports like running and cycling. More positively, the early weeks of lockdown had seen a number of people taking up new sports, including investing in equipment. In fact, our results showed that between 3-4% of respondents had purchased a range of home exercise equipment or materials they needed to take part in new pursuits. In the case of some sports, like cycling, which has seen a decline in commuters as people work from home, this is helping to offset the impact of Coronavirus even before we consider potential long term-benefits.

In part 2, as rumours gather pace about what the sporting future looks like, we explore how participation and spend might react during the ongoing quarantine and lockdown period. Whilst no one knows quite how long this might be, or what exactly the pathway back to playing and watching sport looks like, the results do allow us to assess how consumers may react during this period of uncertainty.

Encouragingly, our findings suggest that new spend could be set to continue growing. More encouragingly still, this planned spend could dwarf the investment in sports equipment that we have already seen.

14%

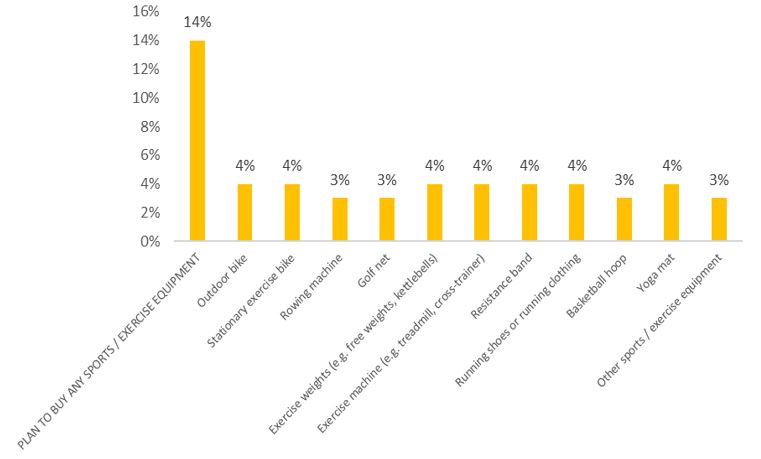

In total 14% of people plan to buy exercise equipment during the pandemic. This is in addition to the one in ten people who had already bought something when we surveyed them during the early stages of lockdown. If true, this would mean almost 8 million adults making a purchase between the time of answering and exiting lockdown. As with early pandemic purchases, prospective buyers are considering a wide range of equipment.

4% of UK adults intend to buy items including outdoor bikes, stationary bikes, exercise machines, running shoes and yoga mats. There are several reasons to believe that the end results will match or exceed this amount. Firstly, there is less competition for the leisure pound from other activities. With cinemas, theatres, concerts, and restaurants off the table, that opens wallets and purses to exercise, particularly among those people for whom exercise is becoming a more frequent or more important pursuit. Simultaneously, the market for exercise goods will be being driven by the non-exercise conditions of lockdown. That is to say that there may be a growing demand for activewear as people spend more time around the house in less formal clothing. We know that even before Coronavirus, almost ¾ of non-runners owned some form of activewear or athleisure apparel, and anecdotal evidence suggests that a new study might reveal an even higher figure.

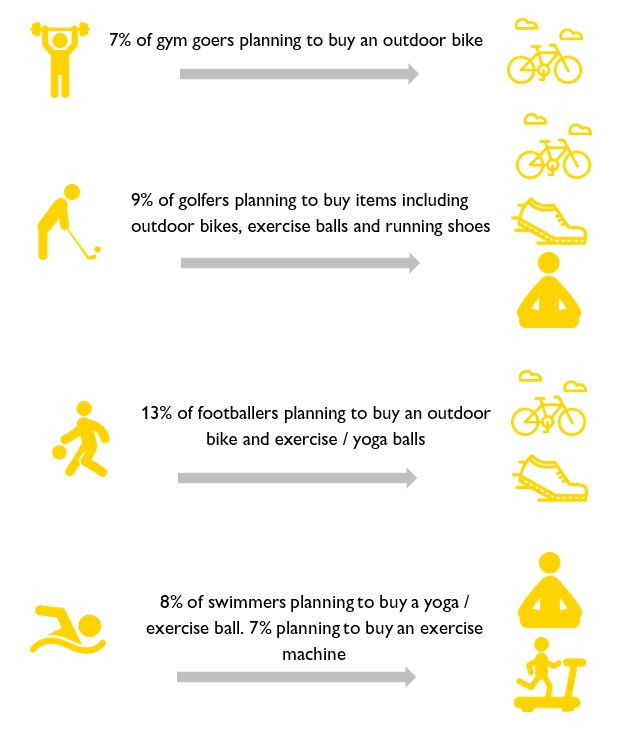

What is also interesting is the profile of people purchasing particular equipment. It is this in particular that sparks hope that many people will emerge from lockdown with new activities and interests to go with their enduring interest in old sports and games. The below figures show the proportion of people planning to purchase equipment during lockdown. This is in addition to those who had already made a purchase of this equipment.

Converting planned spend to real numbers shows the potential revenue available for the sports market. If each of those 14% of UK adults spends an average of £50 on equipment (please note that this figure is for illustrative purposes only and should not be taken as any kind of indication of average spend), that would mean £364m of planned spend during quarantine. That, on top of £260m already committed in the first days and weeks of lockdown (same caveat applies).

This will not necessarily be welcome news for high street retailers, or pop-up boutiques inside sports facilities which have been forced to close their doors during Coronavirus. Shopping during lockdown has so far meant through online chains which are still delivering. In golf for example this will have meant money being diverted to online purchase that might otherwise have flowed through Pro Shops or driving ranges.

The other impact will be to favour those brands who have already invested in diversifying their routes to market. Brands offering direct to consumer sales through their own websites can sell and fulfill orders even as people are housebound. Brands who cannot do this will be losing ground and may continue to do so through lockdown and even recovery.

This is not guaranteed. It could be that as high streets re-open consumers are eager to flock to physical stores. Certainly, some stores that have a loyal client base in their local area may see a boom as people attempt to support their local retailer. It seems more likely however that nervousness and caution will be more enduring outcomes, prompting people to buy more online where possible in the long term. Shops will have to do two things to buck this trend. Firstly, in an extension of a pre-Coronavirus trend, shops will have to do even more to deliver not just products but experiences and provide a compelling reason not to shop online. This might mean further focus on custom fitting, recruitment of expert staff, and spend on in-store activations. Secondly, they will have to go out of their way to reassure and prove to their customers that an in-store experience is safe, without going so far that customers feel intimidated and unlikely to return. Retailers will no doubt be using this time to consider how they can confront these challenges.

Interestingly, one industry that may have escaped some of the retail disparity to date is cycling. Despite having hundreds of brands in play (the Cycling Retail Audit that SMS operates on behalf of the Bicycle Association includes over 1,500 individual cycling brands across bikes, parts, accessories and apparel) and only certain brands offering D2C sales, cycling has been buoyed by the ability of stores, from chains to independents, to remain open, therefore retaining its brand breadth throughout the crisis. With individual shops stocking wildly varying product ranges, and with many providing community focused offers such as cafes, group rides and more, customers may still be encouraged to choose particular outlets when previous shopping habits return. Many cycling shops also report getting more people through the door as consumer demand turns to servicing, maintenance and repair, an area where cycling has much greater revenue potential than other sports.

The cycling industry has also been boosted by the proactive, community-spirited response of its constituent organisations, with many brands and retailers successfully communicating the many measures they have brought in to support emergency workers with free rentals, repairs or donations. A recent Financial Times report even hinted at a surge in medical professionals choosing cycling transport for short journeys, a move which will go some way to offsetting the drop in cycle commuting that is a result of closed workplaces and mass working from home. How the industry’s moral leadership translates into future participation and sales is something that the Bicycle Association’s Cycling Market Data Service will monitor closely.

The results also suggest ongoing promise for e-sports. Many of you may have tuned in, or at least been aware of, the Premier League’s ePL Invitational tournament, a virtual contest streamed live on the BBC sport website, where one player or famous fan from each of the 20 Premier League clubs went head to head on FIFA 20. Striker Diogo Jota triumphed for Wolves, in a contest that will have resonated with the growing number of people playing virtual sport through consoles, phones or computers during lockdown. A peak audience of 52,000 tuned in to watch the event, paltry by televised football standards, but nevertheless respectable for something brand new to most viewers. Perhaps even more interesting is the fact that the Premier League’s tournament was outwatched by other FIFA streams and events, suggesting that the e-sports industry and mainstream sports viewers remain relatively separate.

Elsewhere, records from the video game industry show solid sales figures in the early part of lockdown, despite the closure of many physical stores. As for FIFA itself, the football simulator posted a sales growth of 53% in the final week of March, making it the number 2 selling game overall, and the number 1 paid game across all platforms for that period. When professional sport, tournaments and events are inaccessible, many are turning to virtual immersion as part of a coping mechanism. Returning to our participation figures, we can see that participants in a range of sports are much more likely than the general population to play virtual sport. Against a national average of 18% who play sports games on a console or computer, over 40% of tennis players, golfers and football players report doing so. Although it is an oft repeated statement that e-sports and sports have limited overlap, this may be less true in quarantine than ever before. It could be that most sportsmen become e-sports players even if few e-sports players become sportsmen.

In part three of our series, we will turn to what the post-lockdown period looks like. Will at-home training start to become a more permanent challenger to the gym industry? Will those who have practiced, and invested in equipment for, new sports and activities continue these, and how will that impact on their old habits and sports?